The world of investing can feel scary sometimes. Stocks go up and down. Crypto is unpredictable. That is why so many people look for something solid. They want something they can hold in their hands. If you are looking to secure your wealth, you might want to buy gold bars online. It is a classic way to save money for the future. You do not need to be a millionaire to start. You just need to know where to look. Many investors also choose to buy gold bullion bars online because they are easy to trade. But you have to be careful. The internet has many sellers. Some are great. Some are not. You need a guide to help you find the good ones. This review will help you understand the process. We will look at what to do. We will also look at what not to do.

Why Should You Consider Gold Right Now?

Gold is different from paper money. Governments can print more paper money. They cannot print more gold. This makes gold a good store of value. It tends to keep its worth over time. When the cost of living goes up, gold often goes up too. This protects your buying power. It is like an insurance policy for your savings. You might not get rich overnight. But you probably will not lose everything either. It is a steady investment. It brings peace of mind. You can store it at home. You can also store it in a vault. It is yours. You own it completely. No bank can freeze it. No computer glitch can delete it. That is a powerful feeling. It gives you control over your own money.

Who Can You Trust in this Business?

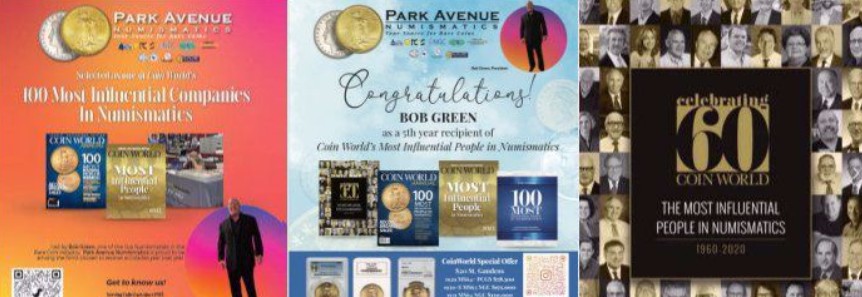

Trust is everything when buying precious metals. You are sending money to a stranger. You hope they send you real gold back. You need to verify the dealer. Look for history. Look for experience. One company you might come across is Park Avenue Numismatics. They have been in the business for a long time. They are not just a website. They are a team of experts. Park Avenue Numismatics specializes in rare coins and precious metals. They help collectors and investors build serious collections. They have a reputation for quality. They offer a wide range of products. This includes gold bars and rare coins. They are based in the United States. This adds a layer of safety. You know where they are. You know they follow US laws.

Understanding the Price You Pay

The price of gold changes every minute. This is called the spot price. It is the price for raw gold on the market. But you will not pay the spot price. You will pay a little more. This extra cost is called the premium. The premium covers the cost of making the bar. It also covers the dealer’s profit. It pays for shipping and insurance too. You need to compare premiums. Some dealers charge a lot. Others charge a little. You want a fair deal. But be careful of deals that look too good. If a price is below the spot price, it is likely a scam. Real gold costs money to mine and refine. Dealers have to make a living. So expect to pay a premium. Just make sure it is reasonable.

The Importance of Physical Possession

When you buy stocks, you get a digital entry. When you buy gold, you get a heavy bar. There is something special about holding it. It feels real. It looks beautiful. But it also creates a challenge. You have to keep it safe. You cannot just leave it on the coffee table. You need a safe. Or you need a hiding spot. Some people use a bank deposit box. Others use a private vault. You have to decide what is best for you. Keeping it at home is cheap. But it has risks like theft. Using a vault is safer. But it costs money every month. You have to weigh the costs. You have to weigh the risks. Think about your comfort level.

How to Spot a Fake Gold Bar

Fake gold is a real problem. Scammers are getting better at making fakes. They plate cheap metal with real gold. It looks real. It weighs almost the same. But it is worthless inside. You need to buy from a trusted source. That is your best defense. But you can also test it. You can check the weight. You can check the size. Real gold is very dense. A small bar is heavy. A fake bar will be too light or too big. You can also use a magnet. Gold is not magnetic. If your bar sticks to a magnet, it is not gold. There are also machines that test gold. Coin shops have them. You can take your bar to a shop to check it.

Reviewing the Buying Experience

Buying online should be easy. You browse the site. You pick your items. You check out. It is like buying clothes or books. But the security is tighter. You might have to verify your identity. This is to prevent fraud. It protects you and the dealer. Shipping is also different. The package will be discreet. It will not say “GOLD INSIDE” on the box. That would be dangerous. It will look like a normal package. It will also be insured. If it gets lost, you get your money back. This is very important. Never buy without insurance. You need to know your investment is safe until it reaches your hands.

A Closer Look at Park Avenue Numismatics

We mentioned them earlier. Let’s look a bit closer. Park Avenue Numismatics stands out for a few reasons. They are not just pushing metal. They understand the history. They understand the value. They offer personalized service. This is rare these days. Most places are just automated websites. But here you can actually talk to someone. They can guide you. They can help you choose the right coins or bars. They have a focus on numismatics. This means they know about rare and collectible coins. But they also handle bullion. They bridge the gap between collectors and investors. This expertise is valuable. It helps you avoid mistakes. It helps you build a better portfolio.

Gold Bars vs. Gold Coins

You have two main choices. You can buy bars. Or you can buy coins. Bars are good for pure investment. They have lower premiums. You get more gold for your money. They are simple. They are easy to stack. Coins are different. They have designs. They are issued by governments. They often cost more. But they are also easier to sell sometimes. People recognize them. They trust them. A Gold Eagle coin is famous. Everyone knows what it is. A generic bar might need to be tested. You have to decide what you want. Do you want the most gold possible? Buy bars. Do you want something beautiful and recognizable? Buy coins.

The Pros of Buying Gold Online

There are many good things about buying online. The first is convenience. You can shop from your couch. You can shop at midnight. You do not have to drive to a shop. You do not have to carry cash. You also have more choices. A local shop has a small inventory. The internet has everything. You can find any size bar you want. You can compare prices easily. You can open five tabs and see who is cheapest. This competition is good for you. It keeps prices down. It forces dealers to be honest. You can also read reviews. You can see what other people say. This helps you avoid bad dealers.

The Cons You Should Know About

It is not all perfect. There are downsides too. The biggest is the wait. You pay today. You get your gold in a week. That gap can be stressful. You worry about the package. You check the tracking number ten times a day. There is also the risk of lost packages. Insurance covers the money. But it is still a hassle. You have to file a claim. You have to wait. Another issue is privacy. Online transactions leave a digital trail. Some people prefer cash. They want total privacy. You cannot do that online. You have to use a bank transfer or credit card. And finally, you cannot hold the item before you buy. You have to trust the picture.

Understanding Weight and Purity

Gold is measured in troy ounces. This is different from a regular ounce. A troy ounce is a little heavier. Make sure you know this. When you see “1 oz,” it means one troy ounce. Purity is also key. Investment gold should be 99.9% pure. This is often written as .999. Sometimes it is .9999. This is called “four nines” gold. It is very pure. Do not buy anything less than .999 for investment. Jewelry is different. It is mixed with other metals to make it hard. Investment bars should be soft and pure. The stamp on the bar will tell you the weight and purity. It should also have the refiner’s name.

Selling Your Gold Later

Buying is only half the process. You also need to think about selling. One day you will want your money back. You need an exit strategy. Who will you sell to? You can sell back to the online dealer. Most of them will buy from you. You can also sell to a local shop. But expect to get less than you paid. You lose the premium. You might also get less than the spot price. The dealer needs to make a profit when they buy too. This is the “spread.” It is the difference between the buy price and the sell price. You need gold to go up enough to cover this spread. That is why gold is a long-term investment. It is not for quick flipping.

Storage Mistakes to Avoid

New investors make mistakes with storage. They tell too many people. They brag about their gold. This makes them a target. Keep it quiet. Only tell people who absolutely need to know. Another mistake is poor security. Hiding gold in a sock drawer is bad. Burglars check there first. Hiding it in the freezer is a cliché. Get a real safe. Bolt it to the floor. If the safe can be carried, it will be stolen. Make it hard for thieves. Also, think about fire. A fireproof safe is good. But even they have limits. If your house burns down, will your gold melt? Gold melts at a high temperature. But it can still be damaged.

The Role of Customer Service

You might not think about customer service until you have a problem. Then it becomes the most important thing. You want a dealer who answers the phone. You want someone who speaks your language. Test this before you buy. Call them up. Ask a question. See how they treat you. If they are rude now, they will be worse later. Park Avenue Numismatics is known for being helpful. They want long-term customers. They are not looking for a quick buck. Good service builds trust. It makes the whole process less stressful. You feel supported. You feel like a partner, not just a number.

Taxes and Reporting

Nobody likes taxes. But you have to deal with them. In some places, you pay sales tax on gold. In other places, you do not. It often depends on how much you buy. Some states want to encourage investment. They remove taxes on bullion. You need to check your local laws. There are also capital gains taxes. If you sell your gold for a profit, you owe money to the government. You have to report it on your tax return. Keep good records. Keep your receipts. Write down the date you bought. Write down the price. You will need this later. It is boring work. But it saves you trouble with the IRS.

Tips for First-Time Buyers

Start small. Do not put your whole life savings into gold at once. Buy one ounce. See how it feels. See how the process works. If you like it, buy more. Dollar-cost averaging is a good strategy. This means you buy a little bit every month. Sometimes the price is high. Sometimes it is low. Over time, it averages out. This reduces your risk. You do not have to guess the market bottom. You just keep accumulating. Also, stick to standard brands. Buy bars from famous refiners like PAMP Suisse or Valcambi. These are easy to sell. Everyone trusts them. Avoid obscure brands that nobody knows.

Avoiding High-Pressure Sales

Some dealers are aggressive. They call you. They try to scare you. They say the economy is collapsing. They say you must buy now. Hang up. This is a bad sign. Reputable dealers do not use fear. They present the facts. They let you decide. They are patient. If someone is pushing you to buy expensive “collectible” coins you do not understand, run away. This is a common trap. They sell you a coin for $5,000 that is worth $1,000. Stick to bullion bars first. They are simple. The price is clear. Do not get talked into something complicated.

Final Verdict on Buying Online

Buying gold online is a great option for modern investors. It gives you access to the best prices. It gives you access to the best variety. But you must be smart. You must do your homework. Verify the seller. Check their reviews. Understand the costs. If you do this, it is very safe. Companies like Park Avenue Numismatics make it easier. They provide a professional service. They give you confidence. Gold is a timeless asset. It has survived wars and crashes. It will likely survive whatever comes next. Adding some to your portfolio is a wise move. It brings balance. It brings security. Just take your time. Don’t rush. And enjoy the feeling of holding real wealth in your hands.

How to Get Started Today

You are ready to take the next step. You have the knowledge. Now you need to take action. Go to a reputable site. Look at the prices. Calculate your budget. decide if you want a 1-ounce bar or a 10-ounce bar. Place your order. Wait for that knock on the door. Open the box. Feel the weight. It is a satisfying moment. You have traded paper for metal. You have traded a promise for a reality. That is the power of gold. It is tangible. It is real. Start your journey today and secure your financial future.