In 2017, the average insurance premium for US families with health insurance through their employers was $18,764. This was a 3% increase from the year before. What this mean value hides, though, is the huge difference between how much health care people in the United States get.

In addition to helping people stay healthy and getting better when they are sick, our health insurance system does at least 6 other things that help everyone who is insured. But these functions don’t always work together.

Financial protection to individuals with catastrophic health events.

Like car insurance, health insurance protects people from events that are hard to predict and could be very expensive. Like car accidents, catastrophic health events happen rarely and are hard to predict. They also cost a lot more than most people can afford. Cancer and MS drugs can cost more than $10,000 per month, which is a lot of money for most people.

Broad access for small usage fees.

Even though the idea behind insurance is to protect against disasters, most people in the United States use their health insurance more like a club membership than like car insurance. In exchange for an annual fee, beneficiaries can get services like regular doctor visits for free or at a low cost out of pocket. Most of these services are predictable, like well-child visits for people with kids or refills for people who take medicines to lower their cholesterol. Club membership policies are usually made to fit the needs of the people who use them. When people with Medicare sign up for Part D prescription drug coverage, for example, licensed insurance agent enter the drugs they are already taking to find the plan that best helps pay for those drugs.

Negotiating health services.

Health insurers use their market power to get doctors, hospitals, and other health care providers to lower their prices or to keep high-cost providers out of their networks.

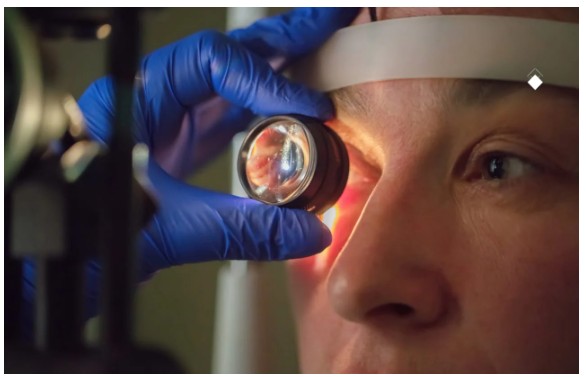

Enhancing and ensuring the quality of clinicians and hospitals.

Both private and public insurers have come up with ways to measure hospitals’ quality in order to keep an eye on them and make them better. Some examples are quality ratings that help patients and plans decide which hospitals to use and preventing certain hospitals from giving certain services based on their quality. There are quality ratings for Medicare advantage plans part c. Medicare says that only hospitals with enough experience and volume can do the transcatheter aortic valve replacement procedure.

Wealth transfer.

Large amounts of money are transferred through health insurance. Medicare and Medicaid are paid for by taxes. People with more money pay more in taxes than people with less money. But health insurance premiums paid by employers and subsidized by taxes help the rich more than they help others.